Disability Insurance

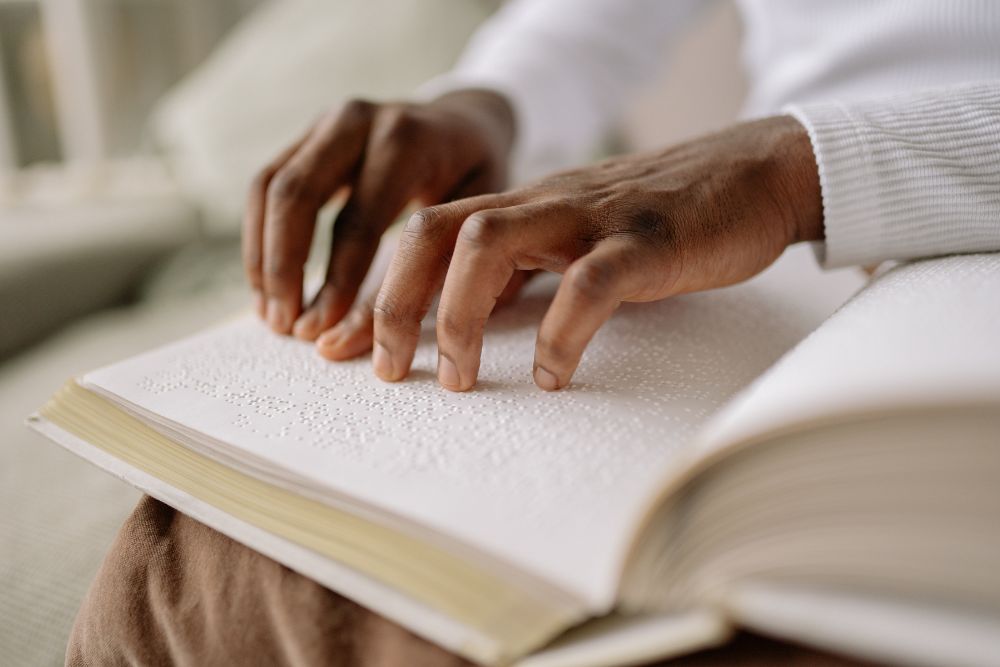

We believe that an illness or injury shouldn’t prevent you from providing for your loved ones. That’s why we offer plans that replace your income and allow you to return to work when you’re ready – not just because you need the money. Our goal is to provide you with the financial support and peace of mind you need during difficult times.

The Importance of Disability Insurance

Disability insurance is essential for financial security. While life insurance covers untimely death, disability insurance protects against serious illnesses or accidents that prevent you from working. Statistics show that disability is more likely to occur during your working years, causing long-term impacts on your earning potential. Without disability insurance, your family’s finances could face a devastating blow.

Types of disability insurance

There are two main types of disability insurance: short-term and long-term. Short-term disability provides benefits for up to 6 months, while long-term insurance takes over afterward. The policies differ in terms of eligibility criteria and the duration of benefits. The choice between “regular or own occupation” and “any occupation” policies is crucial, as it determines the circumstances under which you’ll receive benefits.

Factors & questions

Several factors influence disability insurance decisions. Consider the extent to which your family depends on your income and how your company plan protects you. Don’t underestimate your coverage needs, as new expenses may arise if you become disabled. Seek advice from a financial advisor to find the best policy for your budget and requirements. Before purchasing, ensure you understand the policy terms, premiums, benefits, and whether pre-existing conditions are covered. Asking the right questions will lead you to the most suitable disability insurance plan.